Car Insurance Quotes Things To Know Before You Buy

Wiki Article

The 25-Second Trick For Travel Insurance

Table of ContentsCar Insurance Fundamentals ExplainedRenters Insurance Fundamentals ExplainedNot known Facts About Life InsuranceRumored Buzz on Insurance

You Might Want Special Needs Insurance Policy Too "In contrast to what lots of people think, their home or cars and truck is not their greatest asset. Rather, it is their capability to make an earnings. Yet, several specialists do not guarantee the opportunity of a special needs," stated John Barnes, CFP as well as owner of My Household Life Insurance Policy, in an e-mail to The Balance.

The info listed below focuses on life insurance coverage marketed to individuals. Term Term Insurance coverage is the most basic type of life insurance policy.

The cost per $1,000 of benefit rises as the guaranteed person ages, and it undoubtedly obtains very high when the insured lives to 80 as well as past. The insurance provider can charge a premium that boosts yearly, but that would make it really hard for the majority of people to pay for life insurance at sophisticated ages.

The Facts About Health Insurance Revealed

Insurance coverage are made on the principle that although we can not quit regrettable occasions happening, we can protect ourselves financially versus them. There are a huge number of various insurance plan offered on the marketplace, and also all insurance providers attempt to convince us of the benefits of their certain product. Much so that it can be difficult to make a decision which insurance plans are actually required, as well as which ones we can genuinely live without.Researchers have located that if the primary breadwinner were to die their household would just be able to cover their family expenses for just a couple of months; one in 4 families would have issues covering their outgoings quickly. Most insurance firms recommend that you take out cover for around ten times your annual revenue - insurance.

You ought to likewise factor in childcare expenditures, and future university fees if relevant. There are two primary kinds of life insurance policy plan to pick from: whole life policies, and term life policies. You pay for whole life policies up until you Source die, and you pay for term life plans for a collection duration of time identified when you get the policy.

Health And Wellness Insurance coverage, Health insurance is another one of the four main kinds of insurance policy that specialists recommend. A current research disclosed that sixty 2 percent of personal bankruptcies in the United States in 2007 were as a direct result of illness. A shocking seventy eight percent of these filers had health insurance when their disease started.

Little Known Facts About Medicaid.

Costs differ significantly according to your age, your existing state of wellness, and your way of life. Also if it is not a lawful need to take out car insurance coverage where you live it is very advised that you have some kind of policy in location as you will still have to presume monetary responsibility in the case of a mishap.On top of that, your lorry is commonly one of your most useful possessions, and if it is damaged in an accident you might have a hard time to pay for repair services, or for a substitute. You might likewise find yourself accountable for injuries sustained by your travelers, or the vehicle driver of one more lorry, and also for damages triggered to one more car as a result of your carelessness.

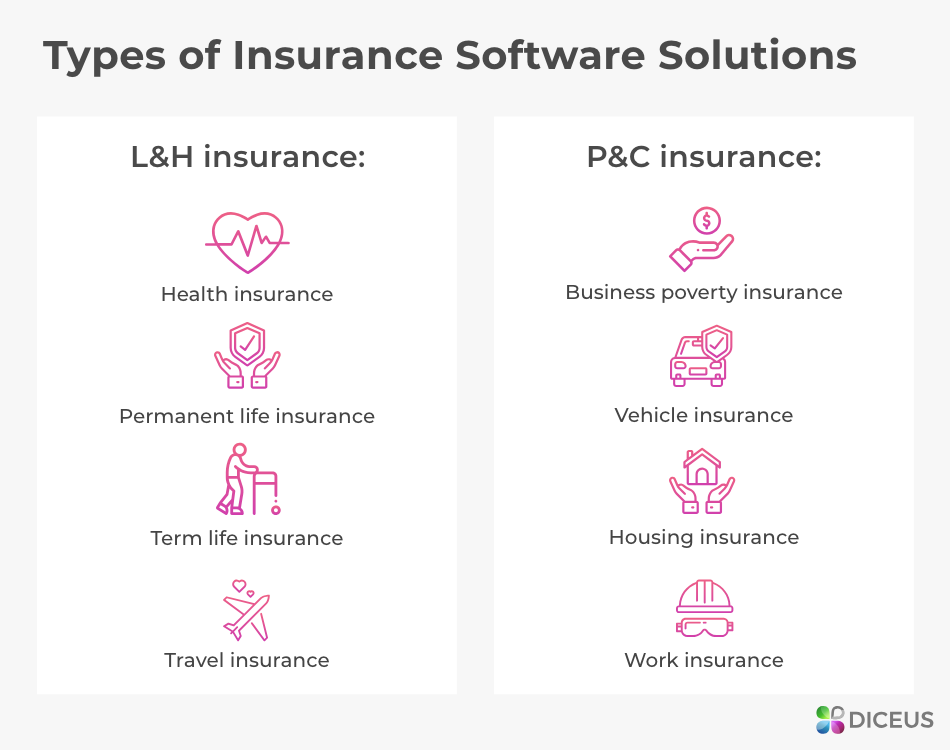

General insurance coverage covers house, your traveling, automobile, as well as health (non-life possessions) from fire, floodings, accidents, synthetic calamities, and also burglary. Various kinds of basic insurance coverage see this here include motor insurance policy, wellness insurance policy, traveling insurance coverage, and also house insurance. A general insurance plan pays for the losses that are sustained by the insured throughout the duration of the policy.

Keep reading to understand more regarding them: As the home is a valuable property, it is very important to secure your residence with a correct. House and house insurance policy protect your residence and the things in it. A house insurance coverage policy basically covers man-made as well as natural scenarios that may lead to damages or my blog loss.

Our Life Insurance Statements

When your lorry is accountable for a crash, third-party insurance coverage takes treatment of the harm created to a third-party. It is additionally essential to keep in mind that third-party motor insurance is required as per the Motor Cars Act, 1988.

A a hospital stay expenses as much as the sum guaranteed. When it concerns medical insurance, one can go with a standalone wellness plan or a family members floater strategy that uses insurance coverage for all household participants. Life insurance coverage gives coverage for your life. If a scenario happens wherein the insurance holder has a premature fatality within the regard to the plan, then the candidate obtains the amount assured by the insurer.

Life insurance policy is different from basic insurance on various parameters: is a temporary agreement whereas life insurance policy is a lasting contract. When it comes to life insurance policy, the advantages and also the amount guaranteed is paid on the maturation of the policy or in case of the policy holder's fatality.

They are nonetheless not mandatory to have. The general insurance coverage cover that is required is third-party responsibility auto insurance policy. This is the minimum coverage that a vehicle ought to have before they can ply on Indian roadways. Every sort of basic insurance policy cover comes with an aim, to offer insurance coverage for a specific aspect.

Report this wiki page